The Yanks have been playing hardball, cutting off Huawei's lifeline to these gizmos, monopolised by the ASML, Nikon, and Canon trio. So, Huawei's throwing wads of cash, up to twice the local rate (we're talking serious dosh here), to lure in the brainiest chip engineers who've been around the block with Applied Materials and ASML.

According to Nikkei Huawei's snapped up hotshots with over 15 years of chip-chopping experience from big names like TSMC and Intel. And with Washington's export controls tighter than a drum, China's chip talent pool is ripe for the picking.

Insiders whisper that Huawei's work culture is tougher than a two-pound steak. "It's brutal," says one weary chip engineer. Forget 9 to 9, six days a week. It's midnight to midnight, seven days straight. Most can't hack it till the contract's up."

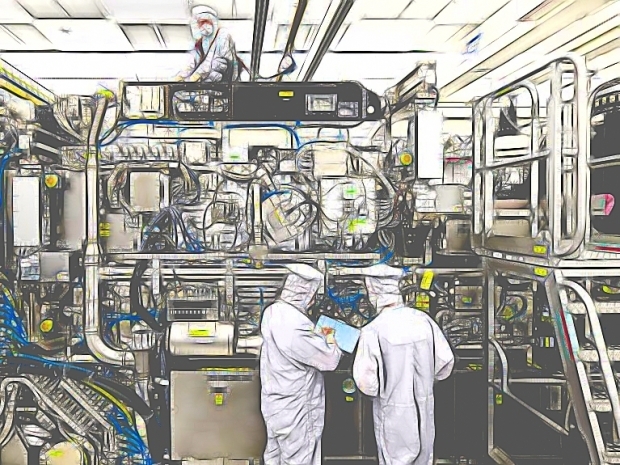

As the chip gear gets caught in the crossfire of US export controls, Huawei's not sitting pretty. It is beefing up its homegrown muscle, with Naura's revenue skyrocketing since 2018.

Huawei's shiny new R&D hub is nestled in Shanghai's Qingpu district, sprawling over a space as big as 224 football pitches. It's set to be a high-tech hive, ready to house over 35,000 workers. The Shanghai government chuffed, listing it as a top project for 2024, with a hefty price tag of about €1.56 billion (12 billion yuan)

Huawei's playing coy, keeping mum on the chip equipment hustle and passing the mic to the Shanghai government.

Last year, Huawei splashed out a record €21.36 billion (164.7 billion yuan) on R&D, a chunky 23.4 per cent of its total revenue. Since getting the cold shoulder from the U.S., they've cosied up with local chipmakers like SMIC and poured cash into domestic chip materials.

Brady Wang from Counterpoint reckons Huawei's doubling down on local suppliers, aiming to stitch up more of its semiconductor supply chain. But it's a marathon, not a sprint.