Super Micro’s product—essentially comprised of the core infrastructure an AI data centre developer would need to run Blackwell chips en masse—has reached “full production availability,” the company said in a statement on Wednesday.

The news eased some concerns about Nvidia’s supply chain constraints, which the chipmaker has raised as a challenge in rolling out its more advanced AI chip.

Wall Street's cocaine nose jobs rushed to buy Nvidia’s shares, which had languished at bargain prices since clinically insane brokers had a fantasy that American companies would rush out and buy DeepSeek systems from China that would need less Nvidia gear.

On Wednesday, the stock jumped by 5.1 per cent to $124.64 in New York.

Nvidia has been facing challenges in ramping up its supply chain to deliver on the production of its new Blackwell chip. Demand for the chips continues to exceed supply. In particular, the company has described the complexities of boosting its supply chain at scale when many custom components are necessary to build its products.

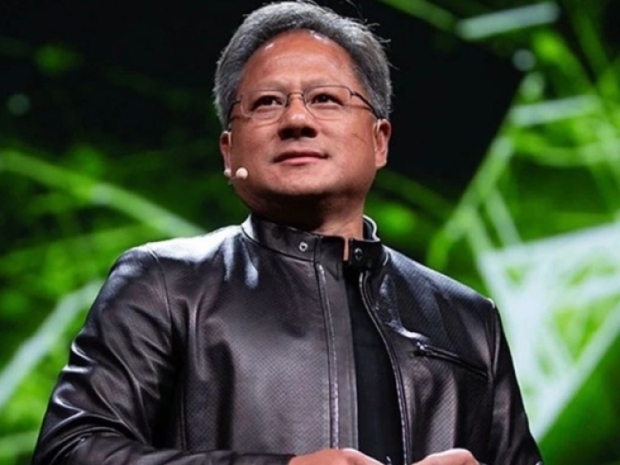

Nvidia Chief Executive Officer Jensen Huang told analysts: “Almost every company in the world seems to be involved in our supply chain.”

The availability of the Blackwell-based products represents a bright spot for Super Micro. In December, it said it would replace its financial and legal leadership, culminating in a tumultuous year in which a former employee alleged in federal court that the company had attempted to overstate its revenue.

Hindenburg Research referenced the employee’s claims in a research report about Super Micro, claiming “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

Its auditor, Ernst & Young, eventually resigned, citing concerns about the company’s governance and transparency.

Following the Hindenburg report, the company is also facing a US Department of Justice probe.