In terms of numbers, Intel reported a revenue of $12.8 billion which is a 1 percent drop compared to the last year. Gross margin is reported at 35.4 percent, down by 0.4 percent, and net income or rather loss is reported at $1.6 billion, with earnings loss per share (GAAP) of 0.38. The non-GAAP gross margin is 38.7 percent, down by 1.1 percent and non-GAAP EPS is at $0.02, down by 0.11 compared to the last year. In the second quarter, the company generated $2.3 billion in cash from operations and paid dividends of $0.5 billion.

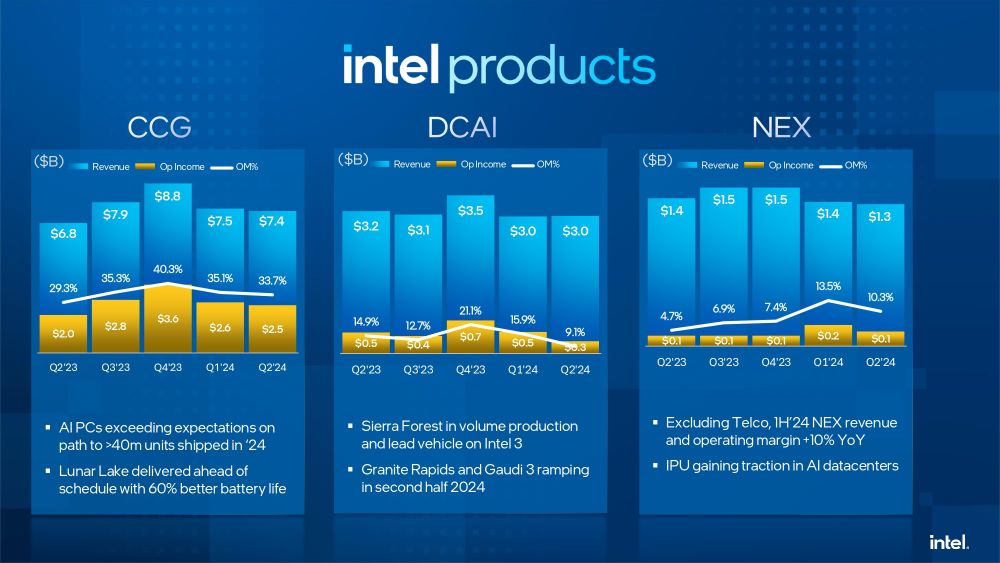

When it comes to specific business units, specifically the Intel Product group, the Client Computing Group reported a revenue of $7.4 billion, up by 9 percent compared to the last year, while Data Center and AI and Network and Edge, reported a revenue of $3 and $1.3 billion, a drop of 3 and 1 percent compared to the last year. The total Intel Products revenue adds up to $11.8 billion, which is up by 4 percent compared to the last year.

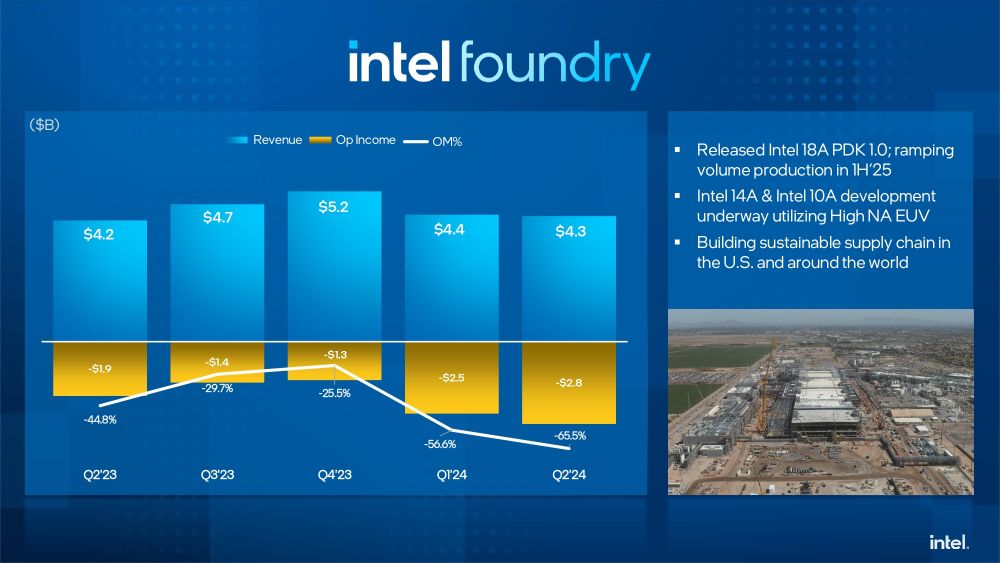

The Intel Foundry group reported a revenue of $4.3 billion, up by 4 percent compared to the last year.

Other business units, which report revenue in millions rather than billions, including Altera and Mobileye, reported a drop of 57 and 3 percent compared to the last year, with $361 and $440 million.

"Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones. Second-half trends are more challenging than we previously expected, and we are leveraging our new operating model to take decisive actions that will improve operating and capital efficiencies while accelerating our IDM 2.0 transformation," said Pat Gelsinger, Intel CEO. "These actions, combined with the launch of Intel 18A next year to regain process technology leadership, will strengthen our position in the market, improve our profitability and create shareholder value."

"Second-quarter results were impacted by gross margin headwinds from the accelerated ramp of our AI PC product, higher than typical charges related to non-core businesses and the impact from unused capacity," said David Zinsner, Intel CFO. "By implementing our spending reductions, we are taking proactive steps to improve our profits and strengthen our balance sheet. We expect these actions to meaningfully improve liquidity and reduce our debt balance while enabling us to make the right investments to drive long-term value for shareholders."

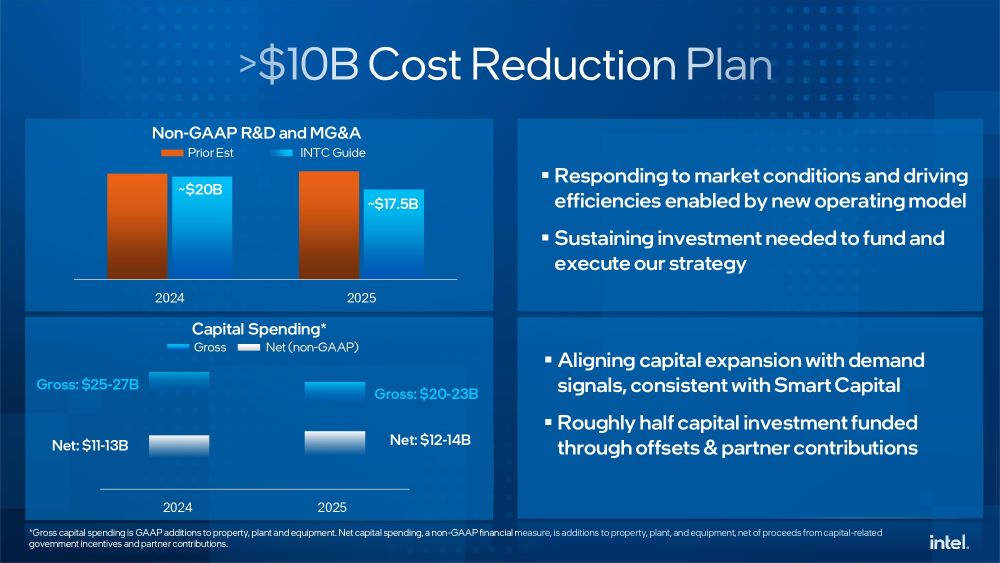

In order to somehow ease up the hit, Intel has announced the new cost-reduction plan, which includes reducing operating expenses with some "meaningfully cut spending and headcount" by reducing its R&D and marketing, general and administrative spending by $20 billion in 2024 and $17.5 billion in 2025 and reducing workforce by more than 15 percent by the end of this year.

Intel also plans to reduce capital expenditures as it draws to the end of its five-nodes-in-four-years journey, which should reduce its gross capital expenditures next year. The company also means to reduce cost of sales next year, generating over $1 billion in savings, and it also means to maintain core investments to execute strategy. Intel will also suspend the dividend starting in the fourth quarter, recognizing the importance of prioritizing liquidity to support the investments needed to execute its strategy.

Intel was keen to note that the company is still on track and nearing completion of its promised five-nodes-in-four-years strategy, with Intel 18A on track to be manufacturing-ready by the end of this year and production wafer start volumes in the first half of 2025. The first two Intel products based on the 18A manufacturing process, Panther Lake for the client market and Clearwater Forest for the server market, are still on track for launch in 2025.

Intel also says that it has shipped more than 15 million AI PCs since December 2023, far more than all of Intel's competitors combined, and on track to ship more than 40 million AI PCs by year-end. Lunar Lake has achieved production release in July and should be shipping in the third quarter, promising to power over 80 new Copilot+ PCs across more than 20 OEMs.

Intel's Data Center and AI business group is betting big on its next-generation Intel Xeon 6 processors, including Sierra Forest with efficiency E-cores and Granite Rapids with P-cores, which should begin shipping in the third quarter of 2024. Of course, we expect Sierra Forest and some Granite Rapids SKUs while the rest should launch in early 2025. The same group is also on track to launch its Gaudi 3 AI accelerator in Q3 this year.

Intel expects revenue of $12.5 to $13.5 billion in Q3 2024, with a gross margin (GAAP) of 34.5 percent and earnings or loss per share of $0.24 (GAAP).

At the time of writing, Intel has taken a big hit with its shares dropping by over 20 percent after the financial report, and over 30 percent in the last year.

Intel's CEO Pat Gelsinger has sent a note to employees after the second-quarter 2024 financial report, promising to save $10 billion in the next year, as detailed earlier. Gelsinger notes that the current cost structure is not competitive, especially considering that the annual revenue of the company in 2020 was $24 billion higher than it was last year and the workforce was 10 percent smaller, stating that it is "not a sustainable path forward."

Gelsinger notes that the future path for the company will not be easy, but still believes that the IDM 2.0 strategy will eventually bear fruit and that the company needs to improve its execution, operate as a more agile company, and adapt to adapt to new market realities.