Last week, Apple reported that sales had been higher than what the cocaine nose jobs of Wall Street had expected and that was the only thing that the Tame Apple Press bothered to report. Basically, sales were five per cent higher due to the latest iPad making a slight comeback.

However, there were some incredibly dark sides to Apple’s results which were not mentioned, played down, or placed under meaningless headlines like “Apple makes a billion dollars of profit every four days.” Some have been so desperate, that they are repeating the news of Apple’s folding phone vapourware which has almost been around as long as its failed self driving car.

What was not been mentioned as that Apple sales declined six per cent to $14.72 billion in greater China, a region that includes Taiwan and Hong Kong. Apple is under pressure in mainland China as local rivals such as Huawei introduce competing products.

Apple’s most important business remains the iPhone, which accounted for about 46 per cent of the company’s sales during the quarter. While the tech giant beat LSEG estimates, the product line still declined about a per cent year over year, to $39.29 billion in revenue. This is hugely bad.

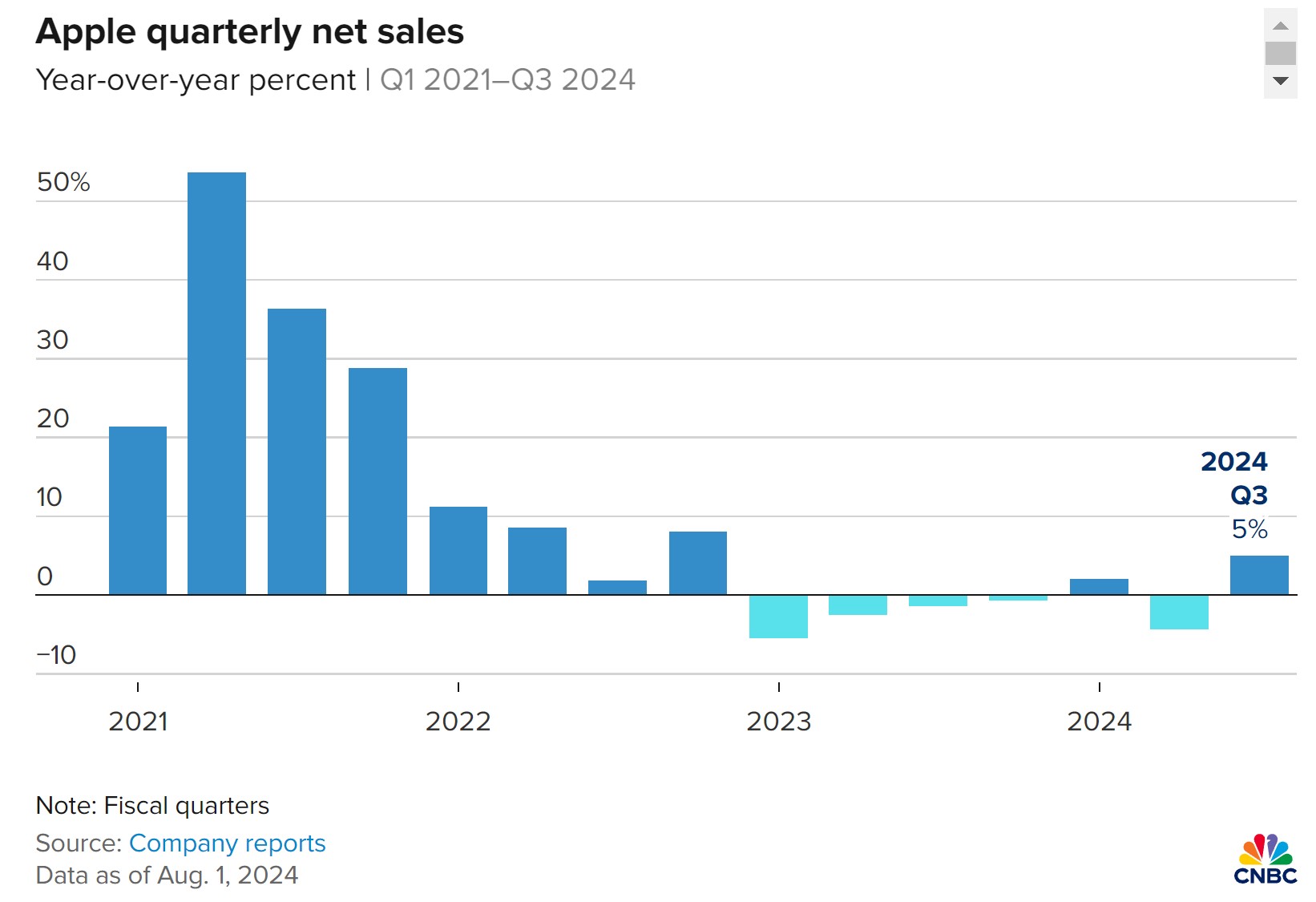

It is also still unable to make any cash out of AI, and not likely to do so in the near future. Those net sales while “better than expected” were still beak in comparison with the past when Jobs Mob was on its game.

In a sign that serious investors are losing faith in Apple, Warrant Buffett announced that he had sold half of his Job’s Mob shares. A long term investor in Apple, Buffett has decided that that company is not going to make him much more money and it was better that the cash was put elsewhere.

The Tame Apple Press has tried to write this off as a tax dodge. Buffett has previously indicated that he has sold "a little bit" of Apple's shares to potentially avoid higher tax rates in the future. Put another way, Buffett is taking a certain profit now, with known variables like a lower tax rate, instead of gambling on uncertainty.

But this is a faulty argument. Another more likely scenario is that Apple has run out of steam and its value is set to fall in the future.